Unlocking the Full Potential of Your Agency with an Insurance Management System

It’s a competitive agency environment. There are over 400,000 insurance agents in the United States, including 4,000 new agencies that emerged during the COVID-19 pandemic. They all serve a market of over $210.4 billion. Excess and surplus (E&S) alone accounts for $80 billion.

Keeping up takes more than great customer service and sales skills. And it means more than just managing one piece of your agency business, like customer relations. To create a competitive advantage, agencies must consolidate and automate communication, commissions, and an increasing cascade of data from all corners of the agency. And that’s where an insurance agency management platform comes in.

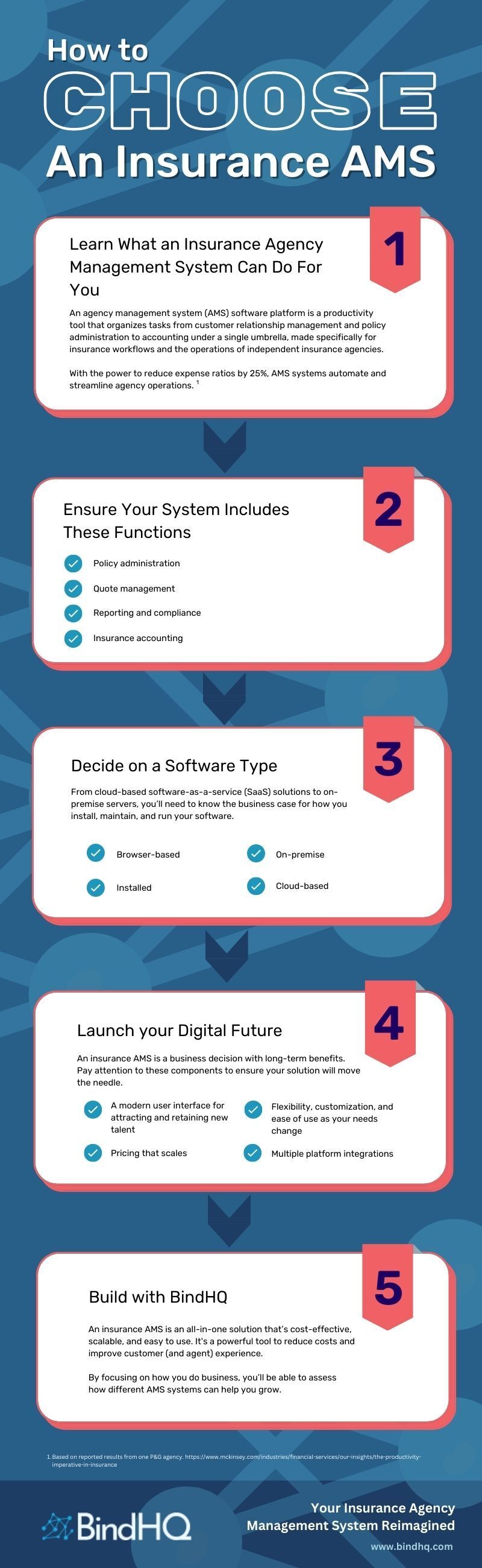

An agency management system (AMS) software platform is a productivity tool that organizes tasks from customer relationship management and policy administration to accounting under a single umbrella, made specifically for insurance workflows and the operations of independent insurance agencies.

It helps agents stop leaping between platforms, inputting data multiple times, and handling tasks like renewals and invoicing manually. With time to write more policies, agencies with AMS insurance agency software lower expenses, save time, and capitalize on these gains to cultivate new business.

| An AMS helped one property & casualty agency reduce expense ratios 25% and achieve an automation ratio of 80% |

As agencies move toward greater centralization, they gain more efficient growth and reign in operating costs. But the cogs of individual agencies don’t all fit together the same way. While some benefit from managing nearly all agency functions in a single tool, others want a tool that augments the systems they already use and love.

We're diving into the features and benefits of modern AMS systems so you can sort through all the options and find the productivity tool that’s best for your business growth.

Important points to consider when purchasing insurance agency management software

Here’s what we’re covering:

- What functions are available?

Make sure you’re matching product features to your business processes, aware of the number of agency functions a tool can manage. From electronic signatures to email integration, and what user experience looks like on a mobile phone, the features are endless, but not all fit the needs of every independent agency.

- What types of software are available?

From cloud-based software-as-a-service (SaaS) solutions to on-premise servers, you’ll need to know the business case for how you install, maintain, and run your software.

- How does the software help launch your digital future?

Lastly, we’re talking about the user interface, integrations, and pricing. An insurance AMS is a business decision with long-term benefits. Pay attention to these components to ensure your solution will move the needle.

Agency functions that can be managed within the platform

Look for these four fundamental functions in order to streamline the basic functions of an agency in a single platform:

- Policy administration

AMS platforms help agents manage policies and policy documents through their lifecycle. Agents can enter submissions, track quotes, manage endorsements, and review documents. Need to renew? Cancel? Change coverages? It’s all in one place.

- Quote management

Allow agents to input personal information once and get quotes to potential customers from multiple insurance carriers that are fast and accurate. Quote management helps agents and customers compare quotes in a single place, increasing credibility, speeding sales, and eliminating paperwork.

- Reporting and compliance

Regardless of the regulations in your state, an AMS can help you stay on top of compliance with robust reporting tools. They make for easier audit trails with features like version control and detailed reporting on demand. Instant reporting also gives managers the power to verify hit rates, revenue, and producer success.

- Insurance accounting

Digital accounting tools can influence managing entities, payment portals, payment histories, invoicing, tracking — even commissions and financial reports. The best AMS can handle E&S tax filing without the need for more software.

Browser-Based, Installed Software, On-Premise, or Cloud-Based?

Browser-based or installed software?

Today, many solutions are browser-based SaaS solutions. They’re accessible from all your devices over the internet, using software that runs through your provider’s servers. That’s sometimes called web-based software, and it comes with benefits:

- You will need less equipment

- Your provider will handle security

- Providers also maintain servers and install updates, fix bugs, and add new features

- It’s convenient and cost-effective

- Your employees can access it from anywhere, on any device

- It will work on your current hardware

Installed software is a little bit different. While you might download it from the internet, you’ll install and run it on your own computers. You won’t need an internet connection to use the software.

On-premise or cloud-based?

With on-premise solutions, you’ll install and run the software from your own servers to your firm’s devices. Typically, you’ll run the software on your local network rather than over the internet.

On-premise software comes at a price. You’ll have to develop and implement the software on your own, at a higher cost, and on a longer timeline. You may require extra IT resources to maintain and update servers and software. Finally, you’ll limit employee access to office devices.

Planning for a Digitized Future

Modern User Interface (UI)

A modern user interface attracts new talent to the industry. With talent shortages and retirements looming, a modern interface prioritizes how agents today interact with their work. It’s both simple and human-centered, with functions that are easy to find and use. With a consistent layout, visual hierarchy, and mobile-responsive design, these user interfaces have other concrete benefits, too:

- Agents find a gentler learning curve, and adoption rates are high

- Employees of all skill levels are included and able to do their jobs, with faster onboarding

- Higher employee satisfaction means less turnover and greater efficiency gains

- The agency gains the distinction of being at the digital forefront, with desirable tools to help employees be more successful and clients enjoy better service

Integrations with other platforms

Integrations are essential to an AMS that helps agencies reduce costs as they write more business and manage mission-critical workflows. First, they allow instant data transfer between applications. That improves accuracy, reduces keystrokes, and gets rid of repetitive tasks. It extends the functionality of the AMS to keep agencies flexible and innovative—even if they can’t anticipate how they’ll need to add to their AMS in the future.

Integrations available include:

- Spreadsheet programs for easier reporting, like Google Workspace and Microsoft 365

- Excellent customer communication tools

- Payment processors like epay

- Carriers, like Markel, Atlantic Casual, and First Insurance, help the seamless transfer of data like policies and endorsements

| 45.2% of insurance agents wish their AMS provided better communication between platforms. |

Integrating carrier and customer data, marketing automation, and accounting leads to efficiency gains, even if the source of your business changes. The AMS platforms that integrate with your existing tools and daily workflows, and that can give you superior insight into business opportunities, are those that can help grow your book of business.

Other considerations

Insurance AMS pricing models make it tough to compare apples to apples. Here are some of the most common pricing plans:

- Subscription-based: This plan requires you to pay a monthly or annual fee to access the software. The cost usually depends on the number of users and the features you need.

- Per-user licensing: With this plan, you pay a one-time fee for each user who will be accessing the software. This can be a good option if you have a small team.

- Tiered pricing: This plan is based on the number of policies or clients you have. The more policies or clients you have, the higher the cost will be.

When making a decision, consider hidden costs like set-up or add-ons, contract length, and how costs scale as your agency grows.

Costs are related to how you’ll use your AMS in the future to realize efficiency gains, so it’s important to weigh the following factors:

- Flexibility, accessibility, and ease of use: Some systems claim to do it all. But when they’re difficult to learn, agents use them less, erasing potential efficiency gains.

- Real-time data updates: Data loss is both frustrating and costly. With real-time updates, agents get the data they need to build better customer relationships. There’s no digging required.

- Enhanced security: Leave security certifications to a cloud-based software company, and know they’re up-to-date on best practices.

- Customization: A system only works if it works for you. If you can configure your AMS to your own needs, you’ll use it more, get more out of it, and scale without changing systems again down the line. Make sure you can incorporate your priorities, like adding a client portal or insurance applications, accessing rating engines, or managing internal communication.

Produce More with BindHQ

An insurance management solution with a modern user interface on the cloud offers numerous benefits. It’s an all-in-one solution that’s cost-effective, scalable, and easy to use. With seamless updates and robust security, a cloud-based insurance AMS can be a powerful tool to reduce costs and improve customer (and agent) experience. And by focusing on how you do business, you’ll be able to assess how different AMS systems can help you grow.

Ready to explore the possibilities today? Book a demo with BindHQ.